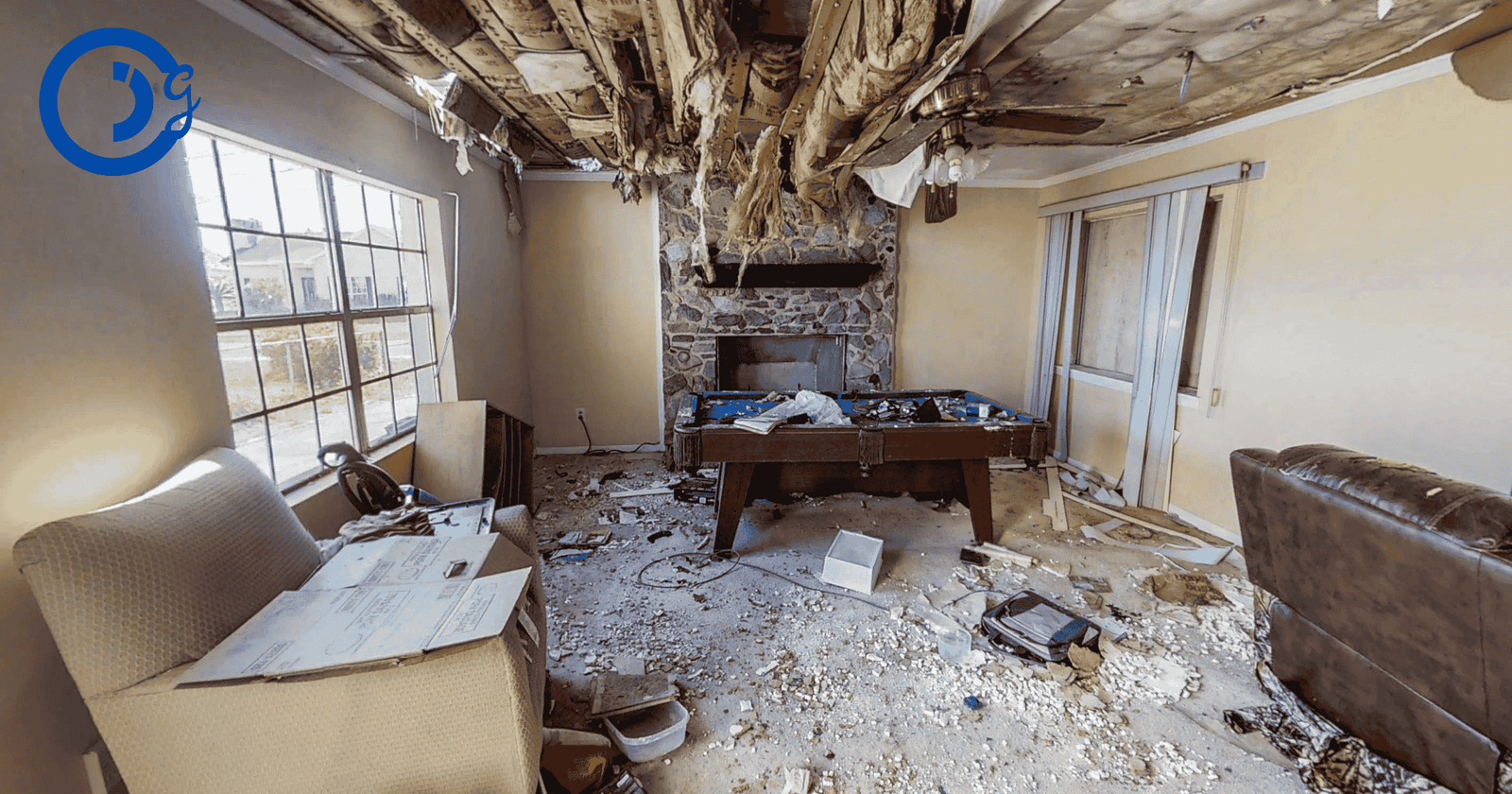

If you’ve ever come home to soaked carpets or dripping ceilings, you know that sinking feeling all too well. Water damage can turn a peaceful day into a nightmare, and the thought of dealing with insurance paperwork only adds to the chaos.

But here’s the truth: filing a water damage insurance claim doesn’t have to be so overwhelming. Over the years, I’ve seen homeowners lose thousands just because they missed small details or didn’t act fast enough. Whether it’s a burst pipe, a leaky roof, or a flooded basement, how you handle the first 24 hours can make or break your claim.

This guide walks you through everything, from what to do the moment water hits to how to make sure your insurer treats you fairly. Let’s save your home, your wallet, and your sanity.

What Is a Water Damage Insurance Claim?

A water damage insurance claim is what you file with your home insurance provider when water suddenly damages your property. It’s basically your way of saying, “Hey, something went wrong, I need help fixing it.”

Not all water-related issues are covered, though. Insurance usually helps with sudden and accidental damage — think burst pipes or a broken water heater. Gradual leaks or poor maintenance? That’s typically on you.

Here’s a quick example:

| Situation | Usually Covered? |

|---|---|

| Burst pipe overnight | ✅ Yes |

| Roof leak after a heavy storm | ✅ Usually |

| Slow leak from old plumbing | ❌ No |

| Flood from rising river | ❌ Needs flood insurance |

So before filing a claim, check your policy’s fine print to see what qualifies.

Why It Matters to Handle Claims the Right Way

Water spreads fast and causes damage even faster. The longer you wait to act or report it, the more likely your insurance company might question your claim.

If handled right, your insurer will help cover repairs, replacements, and even temporary living expenses. But if you skip steps, it can easily turn into a denied claim — and a lot of out-of-pocket costs.

Many homeowners think insurance companies automatically “take care of everything.” In reality, you’ve got to prove your loss and back it up with evidence. That’s why knowing the process is key.

Step-by-Step Water Damage Insurance Claim Tips

1. Stop the Source Immediately

First things first — stop the water. Shut off your main water valve if it’s a plumbing issue. The insurer expects you to take “reasonable steps” to prevent further damage. If you don’t, they might reduce your payout.

2. Document Everything Like a Detective

Pull out your phone and start taking photos and videos — every puddle, every wet wall, every damaged item. Capture the time, date, and cause if you can.

Even small things matter: a damp book, peeling paint, warped wood. Insurers often ask for proof later, so these details could mean the difference between approval and denial.

3. Don’t Rush Cleanup (Yet)

It’s tempting to mop everything right away, but wait until you’ve captured evidence and spoken with your insurance company. Cleaning up too early might erase proof.

If you must clean up for safety reasons, note it down — write, “Removed soaked carpet to prevent mold” and take a quick photo.

4. Notify Your Insurance Company ASAP

Call or email your insurance provider as soon as you can. The faster you report, the quicker they’ll assign an adjuster to inspect. Delays might make them think you didn’t act responsibly.

Keep the tone polite but clear. Mention the date, the cause (if known), and the extent of the damage.

5. Keep Receipts of Emergency Repairs

If you hire someone to stop the leak or dry out the home, save those receipts. Most policies reimburse emergency mitigation costs — as long as they’re reasonable.

Understanding What’s Covered and What’s Not

This is where many homeowners get tripped up. Water damage coverage isn’t one-size-fits-all.

Commonly Covered:

- Burst or frozen pipes

- Accidental overflow from sinks, bathtubs, or washing machines

- Leaks from appliances (if sudden)

- Roof leaks caused by storms

Usually Not Covered:

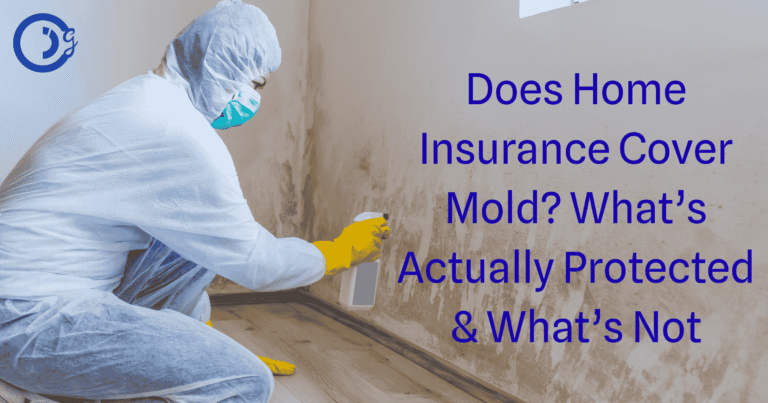

- Water seepage due to poor maintenance

- Long-term leaks or mold buildup

- Groundwater flooding (requires separate flood policy)

- Damage from neglect (like ignoring an old leak)

👉 Internal link idea: You could also check our detailed post on “Homeowners Insurance Coverage Explained” to understand what’s typically protected.

How Insurance Adjusters Evaluate Water Damage

Once you file your claim, your insurance company sends an adjuster. Their job is to assess how bad the damage is and estimate repair costs.

Be present during their visit. Walk them through every affected area. Don’t assume they’ll notice everything — sometimes, they’re in a rush.

Here’s what helps:

- A written list of damaged items

- Photos and videos from before and after

- Receipts or invoices for repairs and replacements

If you disagree with their estimate, you can request a second opinion from a public adjuster (someone who works for you, not the insurer).

Common Mistakes That Lead to Denied Claims

Even honest mistakes can hurt your chances. Here are the ones I’ve seen the most:

- Waiting too long to report damage

- Throwing away damaged items before inspection

- Failing to document clearly

- Making permanent repairs before claim approval

- Assuming flood damage is included (it’s usually not)

Always read your policy’s exclusions. A few minutes of reading can save weeks of frustration.

Pro Tips to Maximize Your Water Damage Claim

These little-known tricks can really make a difference:

🟢 Act Within 24–48 Hours

Insurance companies value fast action. It shows you’re responsible and serious about minimizing damage.

🟢 Get Independent Repair Estimates

Don’t rely solely on the insurer’s adjuster. Get a quote from your own trusted contractor too — it helps you compare and negotiate.

🟢 Ask About Additional Living Expenses

If your home becomes uninhabitable, your policy might cover temporary lodging and food costs. Many people don’t even know this benefit exists!

🟢 Keep a Claim Journal

Jot down every call, date, and person you talk to. If something goes wrong later, your notes become solid evidence.

Real-Life Example: When Fast Action Paid Off

A close friend of mine had a washing machine hose burst while she was at work. By the time she came home, half her living room was under water.

Instead of panicking, she did everything right — shut off the water, took photos, called her insurer immediately, and hired a cleanup team. Within two weeks, her claim was approved for full replacement of her flooring and damaged furniture.

If she’d waited even a day, mold might’ve set in — and the insurer could’ve blamed her for “neglect.”

When to Call in Professionals

Sometimes it’s best to step back and bring in experts.

- Water damage restoration services can prevent mold and salvage materials.

- Public adjusters can handle complex claims or when insurers lowball you.

- Contractors help provide repair estimates that reflect real market rates.

It may cost a little upfront, but it often pays off in faster settlements and fewer disputes.

External Link Suggestion

For more details on what’s covered under homeowners insurance, check the National Association of Insurance Commissioners (NAIC) website — a reliable government-backed resource.

FAQs

Disclaimer

Disclaimer: This article is for general informational purposes only and does not constitute professional insurance advice. Please consult with a licensed insurance advisor before making any decisions.

Conclusion

Water damage can feel like a punch in the gut, but a calm, organized approach can turn the chaos into control. Know your rights, act fast, and keep records — that’s the secret to getting your claim approved and your home restored quickly.

And once you’re back on track, take a moment to review your coverage. You might find it’s time to upgrade or add flood protection.

Stay smart, stay dry — and don’t let a little water wash away your peace of mind.