If you’ve ever walked into your basement and caught that damp, musty smell, you know the sinking feeling that comes next: mold. It spreads fast, looks awful, and can mess up your walls, furniture, and even your health. That’s when most homeowners ask the big question: “Does my home insurance cover mold?”

The short answer? Sometimes yes, sometimes no; it really depends on how the mold got there. I’ve seen neighbors spend thousands fixing damage they thought insurance would handle. And others, surprisingly, got full coverage because their policy clearly explained it.

In this guide, I will break down how home insurance deals with mold damage, when it is covered, when it is not, and what you can do to protect your home (and wallet). Let’s make sure you do not get caught off guard next time you find that fuzzy green patch growing in the corner.

Understanding Mold and Why It Matters

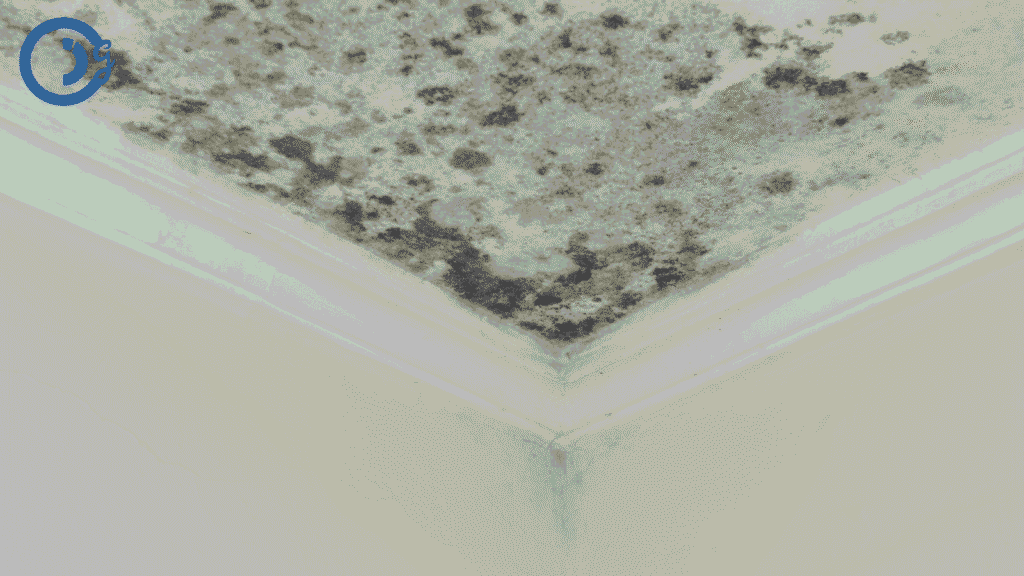

Mold isn’t just an eyesore, it’s a living organism that thrives in moisture. It eats away at drywall, wood, carpet, and sometimes even your peace of mind.

When mold appears, it usually means something else has gone wrong: a leaky pipe, roof damage, poor ventilation, or flooding. Beyond property damage, mold can trigger allergies, breathing issues, and other health problems.

That’s why understanding how your Home Insurance treats mold is crucial. You might assume all damage is covered, but policies often have very specific rules about this.

Does Home Insurance Cover Mold?

Here’s the truth: most standard home insurance policies cover mold damage only if it’s caused by a “covered peril.”

A covered peril means an event your policy specifically protects against — like sudden water damage from a burst pipe or an overflowing washing machine.

So, if a pipe bursts behind your wall and you discover mold growing there later, your insurer might pay to clean it up.

But if the mold forms slowly over time due to neglect, poor ventilation, or ongoing leaks you never fixed — that’s usually not covered.

Common “Covered Perils” That May Include Mold Damage

- Sudden and accidental water discharge (like a burst pipe)

- Appliance overflow (dishwasher, washing machine)

- Ice dams causing roof leaks

- Firefighting efforts that soaked your walls

Situations Usually Not Covered

- Long-term moisture or humidity problems

- Roof leaks that went unrepaired

- Poor ventilation in bathrooms or attics

- Flooding from outside water (unless you have flood insurance)

Insurance companies often see mold as a preventable issue — and they expect homeowners to maintain their property properly.

Real-Life Example: A Tale of Two Leaks

Let’s say Sarah and Tom both discover mold in their basements.

- Sarah’s Case: Her water heater suddenly bursts, flooding the floor. She calls her insurer immediately. Since it was sudden and accidental, her insurance helps cover the mold cleanup.

- Tom’s Case: He noticed a small leak months ago but ignored it. Eventually, mold spread through the wall. His insurer denies the claim because it resulted from neglect.

Same mold problem — completely different outcomes.

Why Mold Coverage Differs by Policy

Not all home insurance policies are built the same. Some include a mold endorsement (an optional add-on) that provides extra coverage. Others cap mold-related claims at a small amount — often $5,000 or less.

Typical Mold Coverage Limits

| Policy Type | Mold Coverage | Example Limit |

|---|---|---|

| Standard homeowners policy | Limited (if sudden damage) | $2,500–$5,000 |

| With mold endorsement | Expanded protection | $10,000–$50,000 |

| Flood insurance (optional) | May cover mold from flooding | Varies by policy |

If you live in a humid state or an older home, that endorsement might be worth every penny.

How to Prevent Mold (and Insurance Headaches)

Insurance companies love proactive homeowners — and honestly, prevention is way cheaper than cleanup. Here are some easy ways to stay ahead:

- Fix leaks right away (even tiny ones)

- Keep humidity levels below 50%

- Use exhaust fans in bathrooms and kitchens

- Clean gutters regularly

- Insulate cold surfaces to prevent condensation

- Inspect your roof at least once a year

💡 Pro Tip: Document home maintenance with photos or receipts. If you ever file a claim, it proves you did your part to prevent damage.

Common Misunderstandings About Mold Coverage

Many people assume “water damage” means “mold is covered.” But insurers separate the two. Even if they pay for water damage, they might not automatically cover the resulting mold cleanup.

Another common myth: “I have flood insurance, so mold is covered.” Not always! Flood policies (like those from FEMA’s National Flood Insurance Program) may limit or exclude mold coverage if you didn’t act quickly enough after the flood.

Always ask your insurer to explain mold coverage clearly — don’t rely on assumptions.

When You Should Consider Extra Mold Coverage

If you live in an area that’s humid or flood-prone — like Florida, Louisiana, or coastal regions — mold is a real threat. Homes with older plumbing or poor ventilation are also more at risk.

Adding a mold endorsement can give peace of mind. It’s often inexpensive compared to the potential cost of remediation, which can easily hit $15,000 or more.

Think of it like this: you’re not just protecting your home’s structure — you’re protecting your health, comfort, and sanity.

From Experience: Dealing with Mold Claims

I once helped a friend navigate a mold claim after a pipe leak under her kitchen sink. She acted fast — took pictures, called the insurer, and got a plumber’s report. Within days, the insurance adjuster approved most of her cleanup costs.

The key was timing. Insurers are far more likely to approve mold claims if you report the cause immediately. Waiting even a few days can make them think it’s “gradual damage.”

If you ever find yourself in this situation:

- Stop the water source immediately.

- Document everything — photos, receipts, dates.

- Contact your insurance agent right away.

- Don’t start big repairs until your insurer inspects the damage.

Internal Link Suggestion: You might also like: [How Much Home Insurance Do I Really Need?] (link to internal article)

External Link Suggestion: For more official guidance, visit FEMA’s Mold Resources.

FAQs

Disclaimer

Disclaimer: This article is for general informational purposes only and does not constitute professional insurance advice. Please consult with a licensed insurance advisor before making any decisions.

Conclusion

Mold is one of those things you never want to deal with — but it happens. Knowing when your home insurance covers mold (and when it doesn’t) can save you a lot of stress and money down the line.

Take time to review your policy, ask your agent about mold endorsements, and stay on top of home maintenance. A little prevention today could mean avoiding a huge financial mess tomorrow.

If you found this guide helpful, explore more of our home insurance articles — they’re written to make real-life coverage questions easy to understand.