Picture this: You’ve finally got that dream car financed or maybe took out a loan for your home. You’re signing the papers, and somewhere near the bottom, the lender asks, “Would you like to add credit life insurance to your policy?”

Most people nod, unsure what that really means — but it sounds safe, right? After all, who wouldn’t want their family protected from leftover debt if something unexpected happened?

Here’s the thing — credit life insurance (yes, that’s the type of life insurance most credit policies are issued as) can be both a blessing and a bit confusing. I’ve seen countless people sign up for it without really understanding how it works, what it covers, or whether they actually need it.

In this guide, I’ll walk you through what type of life insurance credit policies are issued as, why they exist, who should consider them, and some insider tips to help you make the smartest choice for your money and peace of mind.

What Type of Life Insurance Are Credit Policies Issued As?

Credit policies are typically issued as credit life insurance, a specific type of life insurance designed to pay off a borrower’s loan balance if they pass away before the debt is fully repaid.

It’s not like the regular life insurance that protects your whole family’s financial future. Instead, credit life insurance is tied directly to your debt. The payout goes to your lender, not to your family.

So, if you’ve taken a car loan, a mortgage, or a personal loan, this policy ensures your loved ones won’t inherit that debt if the unthinkable happens.

How Credit Life Insurance Actually Works

Let’s say you borrow $40,000 to buy a car. Over time, you’re making payments and reducing that balance. If you pass away with $25,000 still left, your credit life insurance policy kicks in — paying off that $25,000 directly to the lender.

Your family keeps the car without any loan burden. Sounds pretty fair, right? But here’s what many people don’t realize:

- The coverage amount decreases as your loan balance goes down.

- The premium cost stays the same, even though your coverage shrinks.

- The beneficiary is the lender, not your loved ones.

It’s simple protection — but not always the best deal for everyone.

Why Credit Life Insurance Exists

Credit life insurance started as a way to protect lenders, not necessarily borrowers. Banks and finance companies wanted to make sure loans were repaid even if the borrower died unexpectedly.

Over time, it became a way to offer borrowers peace of mind — especially those without any life insurance of their own.

Here’s why it still matters today:

- It prevents your family from inheriting unpaid debt.

- It helps maintain your credit reputation even after death.

- It’s convenient — often added automatically at loan signing.

But convenience shouldn’t replace understanding. It’s always worth comparing it with regular term life insurance before signing anything.

Who Actually Needs Credit Life Insurance?

Honestly? Not everyone. But there are certain cases where it makes sense:

You might consider it if:

- You don’t have any other life insurance coverage.

- You have significant loans but limited savings.

- You want to make sure no one else is stuck with your debts.

- You find it difficult to qualify for standard life insurance due to age or health issues.

You probably don’t need it if:

- You already have term or whole life insurance that covers your debts.

- Your loans are manageable and could be paid by your estate.

- You prefer more flexible coverage where your family gets the payout.

In short: if you already have good life insurance, credit life insurance might be redundant.

Key Benefits of Credit Life Insurance

Despite its limitations, credit life insurance has some real advantages worth knowing:

- Easy to Get: Usually no medical exam or complicated paperwork.

- Debt Protection: Guarantees that your loan is fully paid off if you pass away.

- Automatic Setup: Often built right into your loan agreement.

- Peace of Mind: Lets you focus on your life instead of worrying about “what if.”

It’s a simple, hands-off type of protection — but simplicity sometimes comes with a cost.

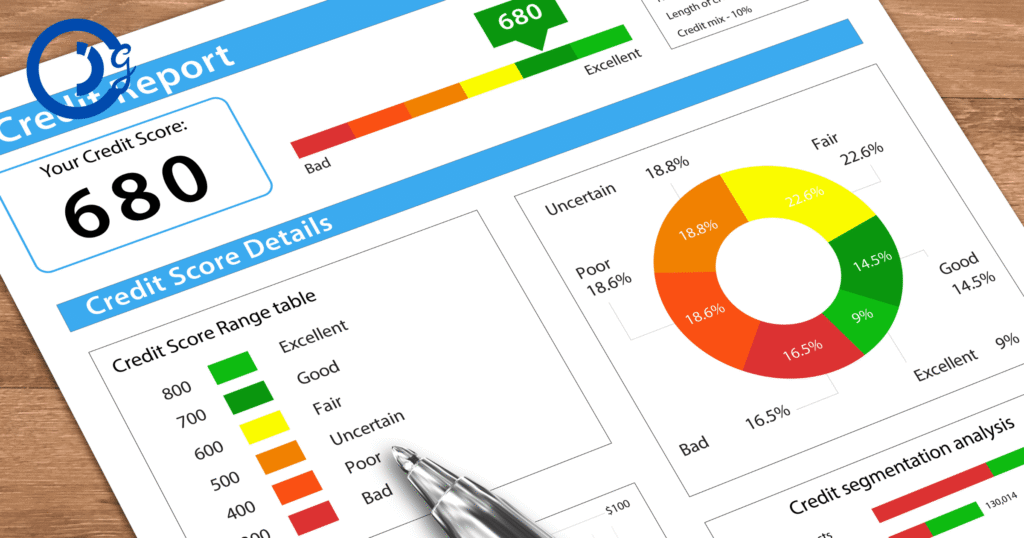

Common Misunderstandings About Credit Life Insurance

Over the years, I’ve seen people misunderstand this policy in a few big ways. Here are some common ones:

| Misunderstanding | Reality |

|---|---|

| “It protects my family.” | Not exactly — it protects the lender. Your family won’t receive any cash. |

| “My coverage stays the same.” | No, your coverage decreases as your loan balance goes down. |

| “It’s required by law.” | Absolutely not. Lenders can’t legally force you to buy it. |

| “It’s cheaper than life insurance.” | Usually not — term life often gives more coverage for less money. |

If you’ve ever been told you “have to” take it, take a step back and ask questions. You have options.

Credit Life vs. Term Life Insurance

To really understand what you’re buying, it helps to compare credit life with traditional term life insurance side by side:

| Feature | Credit Life Insurance | Term Life Insurance |

|---|---|---|

| Beneficiary | Lender | You choose (family, spouse, etc.) |

| Coverage Amount | Decreases as you pay off loan | Stays fixed for the policy term |

| Medical Exam | Usually not required | Sometimes required |

| Purpose | Pays off a specific loan | Provides overall family protection |

| Cost | Can be higher per coverage unit | Usually more cost-effective |

For many people, term life is the smarter, more flexible option. But credit life insurance still serves a purpose for those who can’t qualify for other policies or want immediate debt coverage.

Real-Life Example: A Simple Case

Meet Lisa. She’s 45, took a five-year car loan of $30,000, and added credit life insurance for $10 a month.

Three years later, Lisa passes away unexpectedly. Her loan balance is $12,000. The policy pays that off immediately — her family keeps the car and doesn’t owe a dime.

In Lisa’s case, it worked perfectly because she didn’t have other life insurance.

But if she had a term life policy already covering $100,000, that same debt could’ve been easily paid off by her family — without needing to pay the extra $10 monthly for credit life coverage.

Tips Before Buying Credit Life Insurance

Here’s what I’d personally suggest — from years of seeing people either overpay or underinsure:

- Always ask if it’s optional. Don’t let a lender pressure you.

- Compare term life quotes first. You might save hundreds.

- Check the loan terms carefully. Some include coverage by default.

- Know who gets the payout. It’s usually not your family.

- Review cancellation terms. Some allow you to cancel within 30 days.

If you’re already paying for traditional life insurance, you may not need this at all.

Internal Link Idea: You might also like reading: [Understanding Term vs. Whole Life Insurance – Which One Fits You Best?]

External Link Idea: For official guidance, visit: National Association of Insurance Commissioners (NAIC)

FAQs

Disclaimer

Disclaimer: This Article is for general informational purposes only and does not constitute professional insurance advice. Please consult with a licensed insurance advisor before making any decisions.

Conclusion

Credit life insurance can sound like a no-brainer when you’re signing loan papers, and for some folks, it genuinely offers peace of mind. But like any insurance, it’s worth understanding before saying yes.

If you already have life insurance or can qualify for a better policy, you might not need this extra coverage. However, if you’re loan-heavy, uninsured, or just want your debts handled no matter what, credit life insurance might just give you the comfort you’re looking for.

Whatever you decide, don’t rush it. Read the fine print, ask questions, and choose what truly protects the people (and peace) that matter most to you.