If you or someone you love lives with sickle cell disease, you already know that life can be unpredictable. One day things feel normal, and the next you’re dealing with pain, hospital visits, or new medications. It’s a lot to manage — physically, emotionally, and financially.

That’s where sickle cell disease health insurance becomes more than just paperwork — it’s peace of mind. Many families face confusion or fear when trying to find a plan that truly covers what they need. I’ve seen people spend hours calling different insurance companies, only to be told “it’s a pre-existing condition” or “coverage may vary.”

This article breaks it all down — in plain English. We’ll talk about how health insurance works for sickle cell patients, what to look for in a policy, how to handle denials, and a few real stories that show why having the right coverage matters so much.

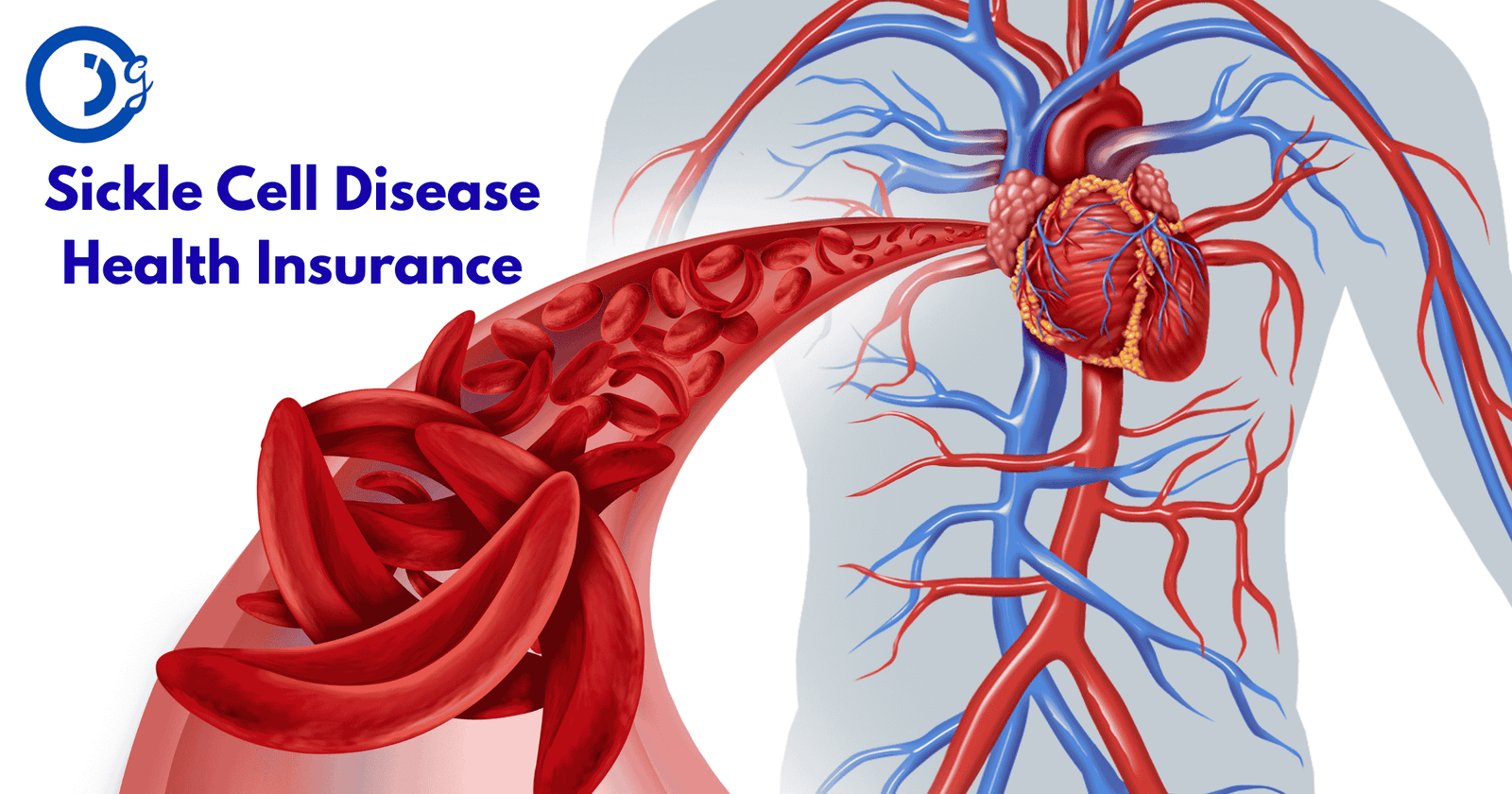

What Is Sickle Cell Disease and Why Insurance Matters

Sickle cell disease (SCD) is an inherited blood disorder that affects the shape of red blood cells. Instead of being round and flexible, they become stiff and crescent-shaped — like a sickle. These oddly shaped cells can block blood flow and cause severe pain, organ damage, and infections.

Because of these complications, people with SCD often need:

- Frequent doctor visits

- Blood transfusions

- Pain management treatments

- Hospitalizations

- Specialized medications like hydroxyurea or voxelotor

All of that adds up quickly — and without insurance, it’s nearly impossible for most families to afford.

Health insurance for sickle cell patients isn’t just about covering hospital bills. It’s about ensuring consistent access to life-saving care and reducing the financial burden that often comes with chronic illness.

Understanding Sickle Cell Disease Health Insurance

When you start looking for health insurance with sickle cell disease, you might feel overwhelmed. The options can seem endless — private insurers, state health programs, Medicaid, employer-sponsored plans, and more.

Here’s a quick breakdown of what to know:

1. Coverage for Pre-Existing Conditions

Thanks to the Affordable Care Act (ACA), insurance companies can’t deny coverage or charge higher premiums for pre-existing conditions — including sickle cell disease. That’s a huge relief for many families who once faced discrimination in health coverage.

2. Medication & Treatment Coverage

Look carefully at your plan’s prescription drug list (formulary). Some life-saving drugs for SCD are expensive, and not every plan covers them equally. If possible, talk to your doctor and your insurer before enrolling to confirm which drugs are included.

3. Specialist Access

Sickle cell care often requires hematologists, pain specialists, and mental health support. Choose a plan that offers access to these experts without excessive referral barriers.

Who Needs Sickle Cell Disease Health Insurance?

Honestly — everyone with SCD does. Whether you’re a child, a teen, or an adult, this disease doesn’t take breaks. You might be stable for months, but a sudden pain crisis can land you in the ER overnight.

That’s why insurance is so critical. It ensures you get care when you need it, not just when you can afford it.

- Parents of children with SCD: You’ll want comprehensive coverage that includes pediatric specialists and genetic counseling.

- Adults managing SCD: Focus on plans with good hospitalization benefits and access to specialty medications.

- Low-income families: Medicaid and state programs often provide full or partial coverage for sickle cell treatment.

Key Benefits of Having the Right Health Insurance

When you’re dealing with a chronic condition like sickle cell disease, the right insurance policy can feel like a safety net. Here’s what it can offer:

- Reduced hospital costs — ER visits, transfusions, and inpatient care are expensive without coverage.

- Regular preventive care — Routine blood tests and checkups can prevent major complications.

- Access to new treatments — Many plans cover FDA-approved drugs and clinical care advancements.

- Mental and emotional support — Some insurers now include mental health counseling for chronic illness patients.

- Peace of mind — You can focus more on living and less on worrying about medical debt.

Real-Life Example: Jamal’s Story

Jamal, a 29-year-old from Georgia, has lived with sickle cell disease since childhood. For years, he avoided getting insurance because he thought no one would cover him. Then a severe pain crisis landed him in the ICU for ten days — and the hospital bill was over $60,000.

After that scare, Jamal researched ACA Marketplace plans and found one with excellent hospital coverage. Within months, his stress levels dropped, and he finally started consistent treatment.

That’s the reality for many people living with SCD.

Common Mistakes When Choosing Insurance for Sickle Cell Disease

Many families rush through plan selection and later regret it. Here are some common mistakes I’ve seen:

- Not checking specialist networks – Some cheaper plans don’t include hematologists or major hospitals known for SCD care.

- Ignoring drug formularies – Always verify that critical medications are covered.

- Overlooking out-of-pocket limits – A plan with low premiums might have high deductibles.

- Missing state assistance options – Many states offer additional help for people with chronic illnesses.

Take your time to compare plans. It’s worth a few extra days to find one that actually fits your needs.

Tips for Getting Better Coverage

Here are some practical steps that can make a big difference:

- Use a licensed insurance agent familiar with chronic illness coverage.

- Look into non-profit assistance programs like the Sickle Cell Disease Association of America (SCDAA).

- Review every plan’s Summary of Benefits and Coverage (SBC) before enrolling.

- Don’t skip open enrollment periods — missing them could mean waiting months for coverage.

- If denied coverage, file an appeal. Many rejections are overturned after review.

👉 Internal link idea: You could also check out a related guide like [“Best Health Insurance for Chronic Illnesses”]* on your own site for more insights.

👉 External link idea: Visit Healthcare.gov for official federal health insurance information.

Table: Quick Comparison of Plan Types for Sickle Cell Patients

| Plan Type | Coverage Level | Specialist Access | Cost | Ideal For |

|---|---|---|---|---|

| Employer Plan | High | Easy | Moderate | Working adults |

| Marketplace (ACA) | High | Varies | Moderate | Self-employed / Families |

| Medicaid | High | Good | Low/Free | Low-income individuals |

| Private Plan | Varies | Depends | Moderate to High | Those needing custom coverage |

FAQs Sickle Cell Disease Health Insurance

Disclaimer

Disclaimer: This article is for general informational purposes only and does not constitute professional insurance advice. Please consult with a licensed insurance advisor before making any decisions.

Conclusion

Living with sickle cell disease already takes strength, patience, and courage — but you don’t have to face financial stress on top of that. The right health insurance plan can ease the weight, giving you access to the care and support you deserve.

Take your time, read the fine print, and ask questions. You’re not just choosing a policy — you’re protecting your future, your health, and your peace of mind.